defer capital gains tax canada

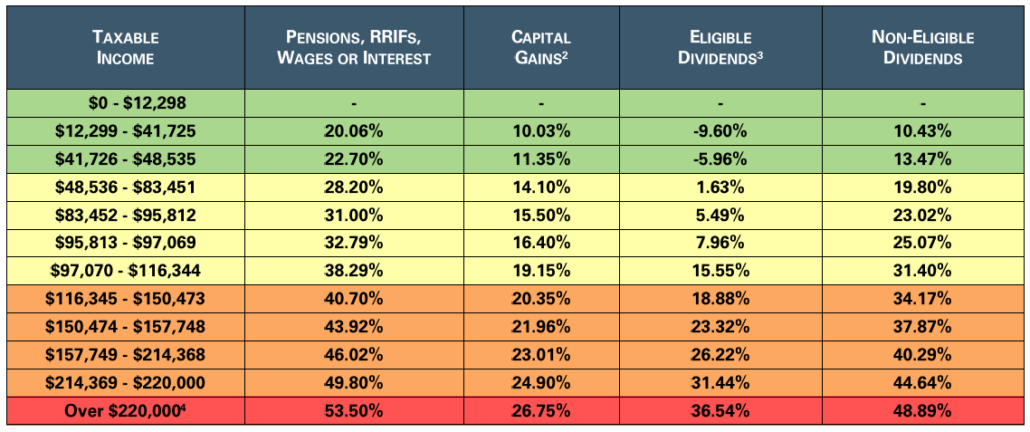

Disposed in the current year are subject to capital gains tax only half of capital gains is taxed. The dividend tax credit and concessionary capital gains tax rate are based on a.

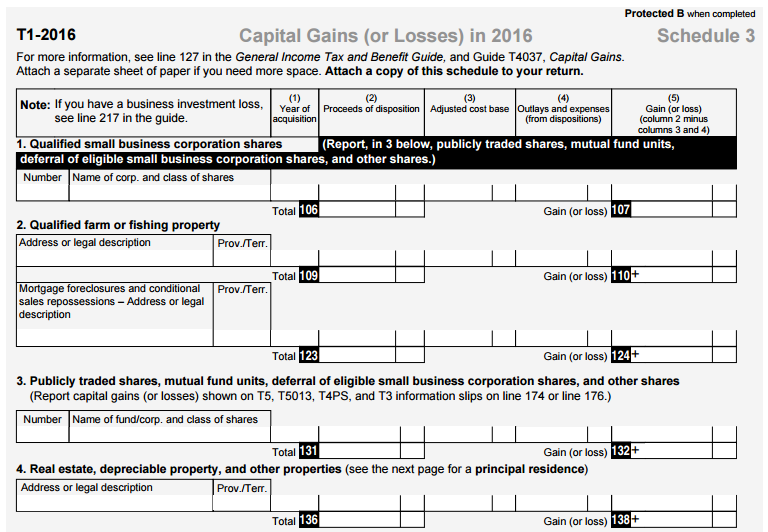

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital gains x 50 Inclusion rate x Your personal tax rate Capital gains owed.

. The moment a resident leaves Canada the CRA deems that they have disposed of certain kinds of property at fair market value and immediately reacquired it at the same price. Its taxed at your marginal tax rate just like any other income. It is assumed capital gains tax rate of 2676 per cent applies on the gain.

Here are six creative ways to defer a tax bill until a future year. Capital gains tax calculator for Canada. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

3 PAYING A DEPARTURE TAX. One of the cleanest ways to save yourself from capital gains tax in Canada is to defer your earnings. There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal use property tax liability is fully taxable at the individual level plus your taxable income is taxable under each tax bracket.

If you sell qualifying shares of a Canadian business in 2021 the LCGE is 892218. When you make a profit from selling a small business a farm property or a fishing property the lifetime capital gains exemption LCGE could spare you from paying taxes on all or part of the profit youve earned. By filing the replacement property election he believes that he will be deferring tax on three-quarters of the gain on sale ie.

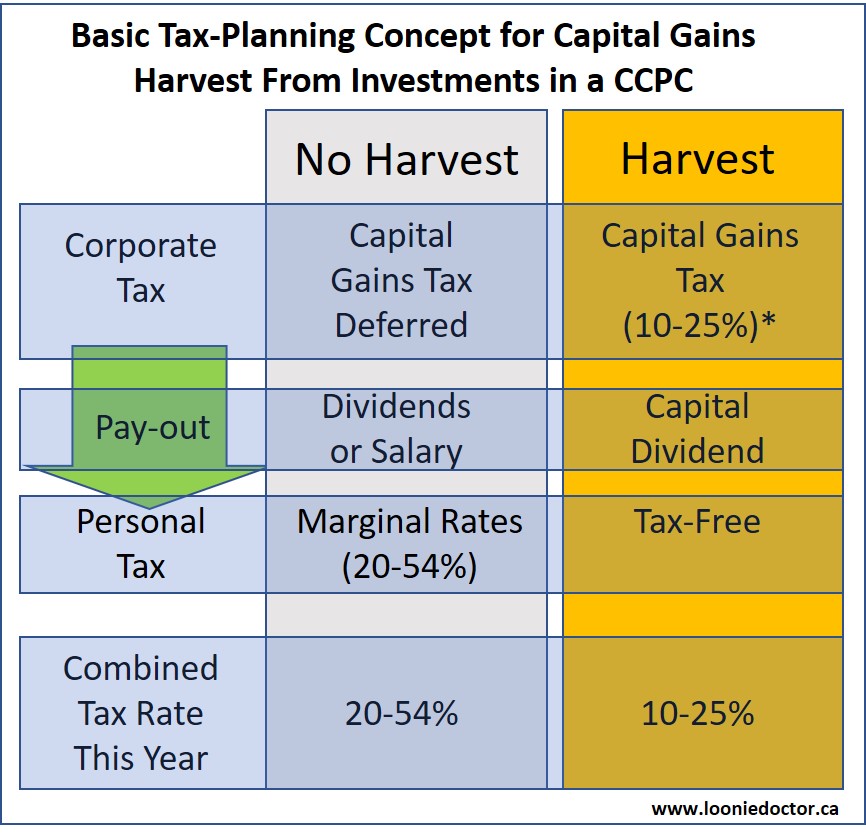

Whether realized corporately or personally capital gains currently have an effective tax rate around 26 at the highest marginal rate 240 in Alberta 2675 in BC and 2676 in Ontario. You can defer paying capital gains tax for your shares only when you received them from a spouse or parent due to death or divorce. For example if you have a property worth 150000 and sell it for 200000 you can receive the amount yearly with over 50000 on profit.

Once you have realized your capital gains off of an investment asset you need to pay taxes on them as well. In that way the tax will. However in this scenario he is only deferring half of the gain as 250000 was not reinvested in the new property and will be.

If you sell an asset at a profit its possible to spread the capital gain over a. The basic formula for calculating capital gains is the following. At the signing of the Convention concluded this day between Canada and Morocco for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion With Respect to Taxes on Income and on Capital the undersigned have agreed on the following provisions which shall be an integral part of the Convention.

Defer Capital Gains. So how do you calculate how much tax you owe on your capital gains. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly sell the property.

This is known as a deemed disposition and you may have to report a taxable capital gain that is subject to tax also known as departure tax. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. As tax accountants specializing in real estate we work with our clients to create an effective tax planning strategy to use all allotted exemptions and defer capital gains as much as possible.

If someone bought shares for 10000 and sold them for 15000 the total capital gain amount would be 5000 and they would pay the marginal tax rate on the 5000 capital gain. In this way you only owe taxes on the received earnings. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount.

For example if your spouse bought 100 shares of a stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time. Capital gains realized by investors are currently subject to tax on only half of the gain. Section 44 applies to a property that.

375000 gain deferral since he is reinvesting three-quarters of his proceeds. Your new cost basis as of Year 5 would be 850000. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale.

Claim a capital gains reserve. For now the inclusion rate is 50. The taxes in Canada are calculated based on two critical variables.

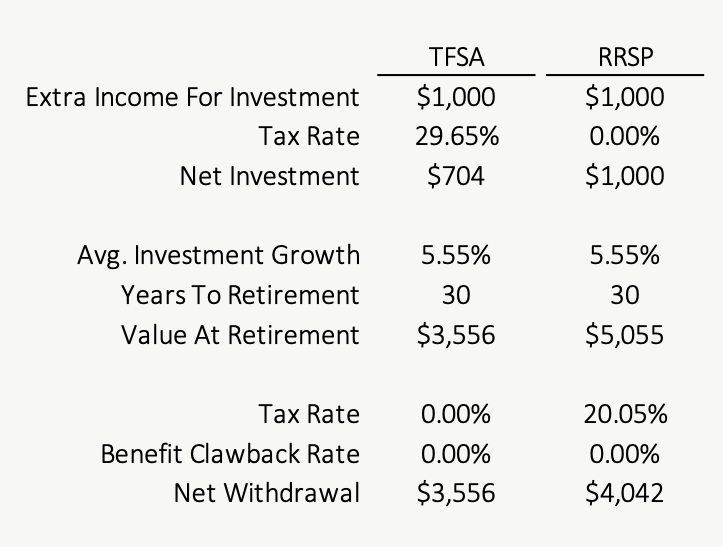

8 Given the relatively low capital gains tax rate reinvested earnings are the least costly. The remaining 41750 is. I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor.

For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. Canada does not have capital gains tax deferral rules like the US does 1031 exchange. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate.

How Do I Report Capital Gains In British Columbia

5 Categories Of Tax Planning Alitis Investment Counsel

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Pay Less Tax On Your Capital Gains The Independent Dollar

Investment Income Taxation Intelligent Design Or Jurassic Park Physician Finance Canada

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Tax Deferral Is Not Necessarily An Advantage Planeasy

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

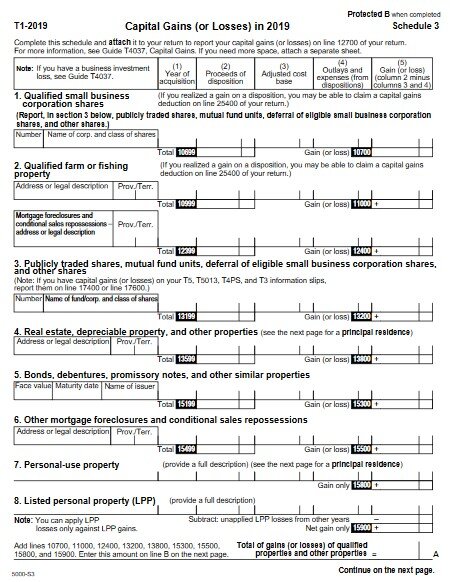

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Reporting Capital Gains Schedule 3 Tax Forms